Tax Incentive to Start US Economic Engine

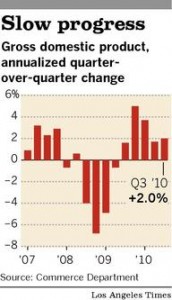

US quarterly GDP data released by Commerce Department showed a modest 2% growth in the third quarter of the year.The recession was over a year ago, but the economy has not shown enough steam to move ahead to stimulate job and spending growth.

GDP data is showing a continued existence of unemployment, spending contraction, poor business environment and housing market, which will continue to inflict pain of recession on the US economy.

This brings us to the inevitable tax changes on the personal and business income in 2011. It is pretty much confirmed, in US people making over $250,000 will bear a higher tax burden in 2011.

With the GDP results, US President Obama, tried to gain support for his proposal for accelerated tax write-offs for business investments for equipment.

Reason being, businesses will invest in new equipments, hire skilled workers and increase productivity and save on income tax.

But smart businesses will look at the GDP data and the future outlook is not rosy enough for them to beef up productivity and start hiring, just to increase stored inventory.

This time, sustained economic recovery’s main catalyst is real recovery in the labor market. Until people have jobs and businesses gets confidence to hire new employees, US is faced with a continued slow or negative growth in the economic recovery from recession.

After spending increase in this holiday season, the first quarter of 2011 GDP is expected to contract and nose dive confirming, US businesses does not have confidence in published economic recovery news in the media or by the politicians.

Why BC Provincial Income Tax Rate Cut to Can’t Save HST

On October 29, 2010 BC Premier Gordon Campbell in a Television Advertisement announced 15% Provincial Income Tax Rate cut on an income up to $72,000, starting January 1, 2011.

Underlying assumption is this income tax rate cut will give people more money in hand to cover the cost of HST.

How much money people will be saving?

“Immediate savings of $354 for people making $50,000/year and up to $616 for those making $72,293 or more.”

Let’s do the math here. If you are making $50,000 this tax cut will save you 0.7% of your income and if you are making $72,293 you will be saving 0.85% of your income. As far as I am concerned, this tax savings is insignificant. People making over $50,000 do not care about saving 354/year.

People who would benefit from this will still pay 100% of HST. Over 80% of BC residents make less than $30,000 per year. How much savings are they going to get with this income tax rate cut? Is this tax savings going to cover the HST impact on their expenses?

Bottom line, HST is good for business and the province and Income Tax Rate Cut is a welcome relief. But HST is still going to hurt consumers. Now its time for businesses to stand up and announce the savings they are transferring to consumers.

Home Buyers Are Ignorant about HST in British Columbia and Ontario

I wrote about this myths about HST is causing a havoc in real estate market where HST was introduced in July 2009.

Home buyers are ignorant about HST and also real estate experts have failed to send the message about the net effect of HST to the prospective home buyers.

A recent study confirms my conclusion about HST and Real Estate market.

Smart People Making Stupid Decisions (Tax, that is!)

Soda pop is making us fat/obese. Yes! That is the conclusion of an expert panel, selected by the Canadian Heart and Stroke foundation.

Soda pop is making us fat/obese. Yes! That is the conclusion of an expert panel, selected by the Canadian Heart and Stroke foundation.

The experts are also indirectly saying Coke/Pepsi and all other sugared drink is cause of our Heart Attacks and Strokes.

What is the solution the expert panel recommended?

TAX everything that poor can afford to buy, starting with soda pop, fast food, processed food. Their assumption is by shifting the price point of unhealthy food, people will start to eat healthy food.

Why not look it the other way? Bring down the price of healthy food. Lets make it in par with junk food. That was not in the recommendation.

This TAX approach has been tried in many places and has proven to be ineffective.

Imposing a TAX on products does not shift buying behavior. Sometime it encourages to consume more by the buyers to show the vanity they can afford to buy an expensive item.

Example… Price of Gas. Gas is being taxed to the extreme and whenever the city or province needs money, they add a new TAX on gas. Did it discourage driving? Just few weeks ago, a report came out, the Canadian Car Companied are having record breaking sales.

To stop Obesity and create healthy nations with strong heart, we need to target the root underline cause.

People are buying unhealthy food, because that is what they can afford. Price of heart healthy food is out of reach to most people. People buying so called junk food probably does not have a steady source of income or job.

This is how we need to tackle Canada’s obesity problem.

1. Educate people about healthy food and junk food and let them decide without being forced to a decision.

2. Put as many options out there for physical activity as possible

3. Create jobs to put more money in the pockets of poor people

4. Bring down the price of healthy food and drinks (don’t see this point raised by any experts).

Annual Report of Taxpayers Ombudsman

Taxpayer’s Ombudsman created little over 2 years ago to provide and independent and impartial review of individual taxpayer complaints as well as addresses any widespread service-related issue at the CRA.

As a Canadian Taxpayer if you feel like you are being mistreated by the CRA, you can take your complain to Taxpayer’s Ombudsman.

On behalf of Taxpayers, the Ombudsman will take the complaint to CRA and ask for an investigation. In some cases the result of investigation might be favourable to the taxpayer.

The Ombudsman has filed its second annual report of annual activities on October 7, 2010. The report details the cases they have intervened on behalf of the taxpayers.

You can download the annual report here.