Do not, I say again Do not do your tax this way.

Here is a great entertainment piece of how to do your tax. No wonder, CPA’s are teaching their kids and other kids on how to pay tax. On an income of $100,000 you pay $26,230 in tax in Ontario. There are no comments about how to reduce the tax. Claim all the tax deductions and tax credits and pay 1% in tax rather than 26% tax on the same $100,000 income.

How To Write Off Your Tax Debt

Canada Revenue Agency has written off almost $4 billion in tax debt over the last two years.

Outstanding and Collectable tax balance for the federal agency stands at almost $29 billion. When a taxpayer properly disputes a tax bill or assessment, CRA must stop all collection efforts of the unpaid tax, until the dispute is settled internally or at the highest level of tax court. It takes many years to close a disputed case, if he tax payer is willing to fight with CRA to the end.

After reviewing the tax debt, CRA decided to write off $3.4 billion in tax debt. As per CRA these were declared uncollectible because may have died, filed bankruptcy and sought relief of the tax debt, could not be located in Canada or lived outside Canada. And is some cases officials considered it is not worth the expense to pursue collection or reached a compromise settlement with the tax debtor.

Despite the fact most of the tax payers in Canada are sought after with iron fists by the CRA if they do not pay the owed tax voluntarily, these lucky tax payers somehow forgiven $3.4 billion in taxes owed by them. It was revealed in disclosed documents that 2 of these accounts owed more than $10 million in outstanding taxes.

How would you have liked CRA to write off your tax debt? more »

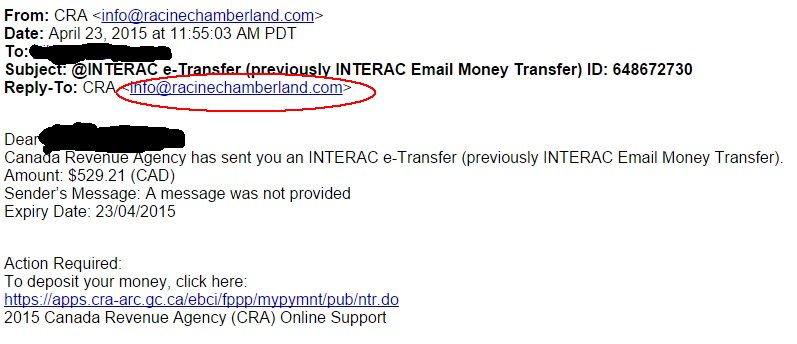

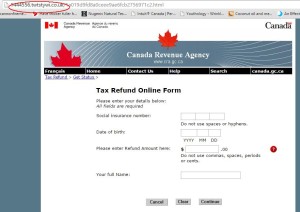

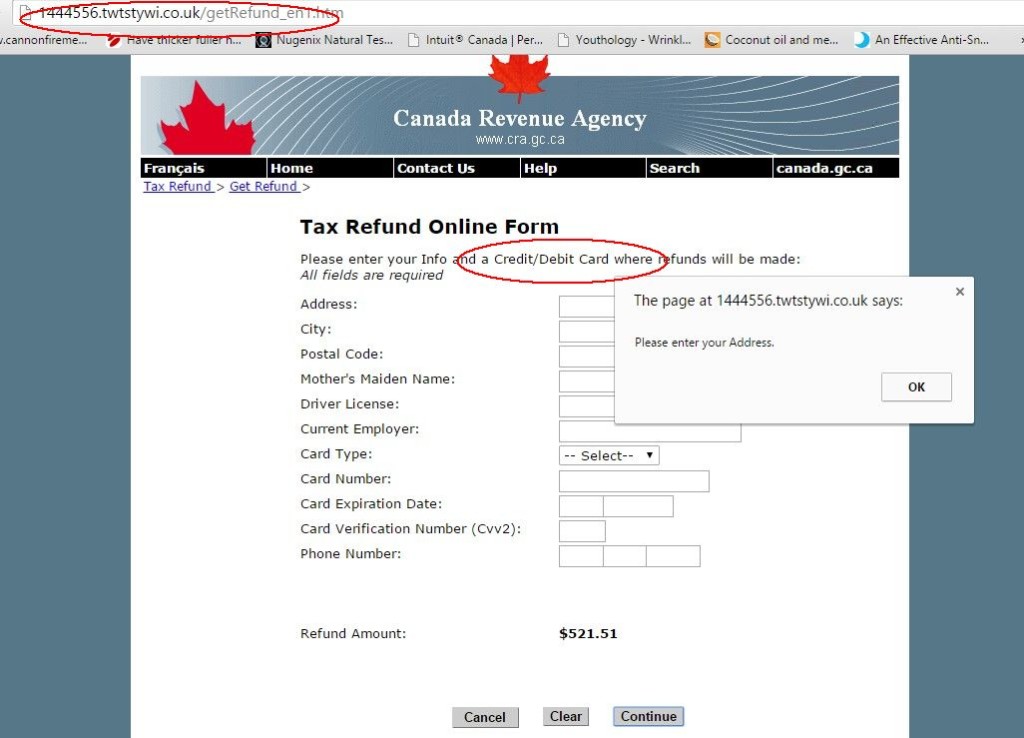

TAX Refund SCAM Warning

Time is counting down to file your income tax return by April 30th. Already many of you have filed your tax return and anxiously waiting for the tax return to be processed and refund either come into mail or directly deposited to your bank account with CRA records.

Unfortunately scammer are taking account of this dire situation and pulling out all their tricks to steal your identity information. A tax return contains the most private information about you. You can only get access to that information through CRA secured web site and logging into your “MY ACCOUNT”.

This phishing scheme just came to my attention. Scammers are sending a fake email informing that CRA is sending them their refund by email money transfer. The fraud scheme seems to be highly sophisticated. They have the CRA banner with actual link to CRA web sites. The Form looks very similar to CRA on line forms. But the URL gives out that it is not a CRA website.

For your identity protection and security reason, do not send any information through CRA website. Use snail mail or call them direct.

Canada Revenue Agency Income Tax

by admin

Comments Off on Year End Tax Tips – Pay Less Tax in 2014

Year End Tax Tips – Pay Less Tax in 2014

While 99% of us are busy shopping, eating and drinking and complaining about the sorry state of our finances, 1% of people (the wealthy ones) are meeting with their tax advisors and planning all out, how to minimize their taxes and maximize their after tax income. You see, in Canada for every $100 taxable income reduction by tax planning you save almost $44 in taxes. You can easily pay off your holiday shopping bill with just few simple year end tax saving strategy.

While 99% of us are busy shopping, eating and drinking and complaining about the sorry state of our finances, 1% of people (the wealthy ones) are meeting with their tax advisors and planning all out, how to minimize their taxes and maximize their after tax income. You see, in Canada for every $100 taxable income reduction by tax planning you save almost $44 in taxes. You can easily pay off your holiday shopping bill with just few simple year end tax saving strategy.

Tax planning is a year around activity. But if you ignored it, all year long, this last few days of the year, where you must take action to minimize your 2014 tax.

So, here are some ideas. more »

Question about FATCA Answered and CRA Backstabbing

FATCA (U.S. Foreign Account Tax Compliance Act) is about compliance of US Tax Law. USA citizens abroad have been negligent (ignorant) about USA TAX LAWS, which states that all “U.S. persons” are liable for U.S. tax, regardless of where they live in the world. Being ignorant about the Tax Law is not an excuse, if you are a U.S. person living abroad, from your tax obligation to USA.

Are you a U.S. Person for tax purposes? This is the first question you have to answer regardless if you have lived in USA or not. You are a U.S. Person, with Tax obligation to USA, if you were born in USA and/or have a USA birth certificate, you have a USA passport and/or green card, or you have a USA Social Security Number (SSN). By law, you must file your annual tax to IRS, no matter where you live in the world. If you do not, you are breaking the USA tax law.

FATCA is a tool, implemented by USA lawmakers to bring out the U.S. persons, who are breaking the USA tax laws. So, if you do not like FATCA and it is applicable to you, only way to get out of this is give up/surrender/relinquish your USA citizenship/passport. Claiming ignorance or stating that you have never been in the USA will not get you any result.

How the FATCA is implemented that is of concern to many Canadians as well as dual Canada/USA citizens. more »