RRSP or TFSA

Forget about all the research and survey from the banks about what the Canadians are doing for their retirement. You let us know. Where are you saving your money for retirement?

RRSP is Hijacking Your Retirement

RRSP is a SCAM run by the Bank and our Federal Government. You do not need an RRSP to save taxes. RRSP is worse than tax in some situations. Do not listen to your bank teller or advisor that if you need to save tax, put money away in RRSP. RRSP is ruining your retirement.

FOREIGN PERSONS U.S. TAX REFUND IS IN OBLIVION

A foreign person’s U.S. source income is subject to 30% withholding tax by the withholding agents.

Withholding agents of foreign persons’ income tax could be their employers, payroll processors, financial institutions, property management company etc. These agents have the responsibility to collect 30% withholding tax on the gross income and remit it to IRS on time using Form 1042 and Form 1042-S.

Foreign persons’ are also given a copy of 1042-S by the withholding agents and they can use the forms to claim credit of taxes paid on their 1040NR or 1120F tax returns. Since the tax withheld in advance is on gross income, and actual tax is based on net income, most of the foreign person tax filer end up with a refund form IRS.

more »

How To Write Off Your Tax Debt

Canada Revenue Agency has written off almost $4 billion in tax debt over the last two years.

Outstanding and Collectable tax balance for the federal agency stands at almost $29 billion. When a taxpayer properly disputes a tax bill or assessment, CRA must stop all collection efforts of the unpaid tax, until the dispute is settled internally or at the highest level of tax court. It takes many years to close a disputed case, if he tax payer is willing to fight with CRA to the end.

After reviewing the tax debt, CRA decided to write off $3.4 billion in tax debt. As per CRA these were declared uncollectible because may have died, filed bankruptcy and sought relief of the tax debt, could not be located in Canada or lived outside Canada. And is some cases officials considered it is not worth the expense to pursue collection or reached a compromise settlement with the tax debtor.

Despite the fact most of the tax payers in Canada are sought after with iron fists by the CRA if they do not pay the owed tax voluntarily, these lucky tax payers somehow forgiven $3.4 billion in taxes owed by them. It was revealed in disclosed documents that 2 of these accounts owed more than $10 million in outstanding taxes.

How would you have liked CRA to write off your tax debt? more »

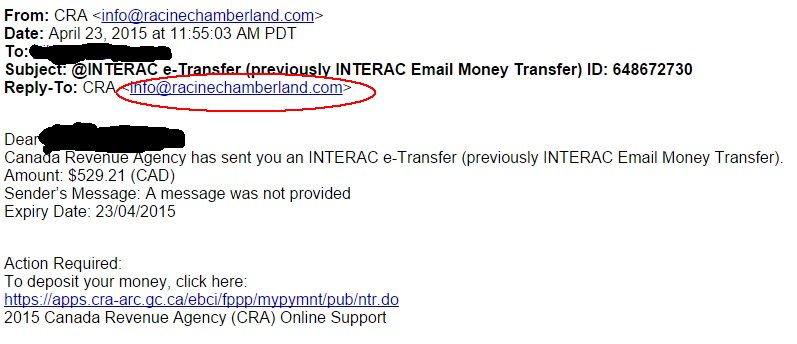

TAX Refund SCAM Warning

Time is counting down to file your income tax return by April 30th. Already many of you have filed your tax return and anxiously waiting for the tax return to be processed and refund either come into mail or directly deposited to your bank account with CRA records.

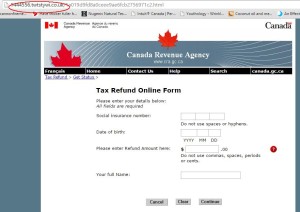

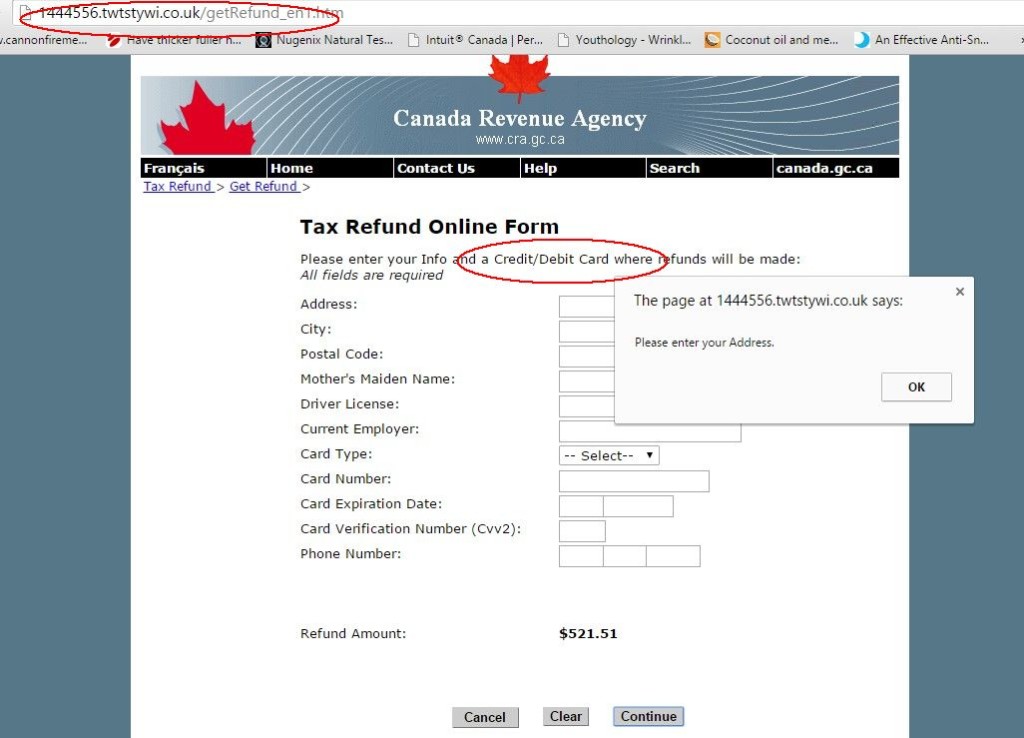

Unfortunately scammer are taking account of this dire situation and pulling out all their tricks to steal your identity information. A tax return contains the most private information about you. You can only get access to that information through CRA secured web site and logging into your “MY ACCOUNT”.

This phishing scheme just came to my attention. Scammers are sending a fake email informing that CRA is sending them their refund by email money transfer. The fraud scheme seems to be highly sophisticated. They have the CRA banner with actual link to CRA web sites. The Form looks very similar to CRA on line forms. But the URL gives out that it is not a CRA website.

For your identity protection and security reason, do not send any information through CRA website. Use snail mail or call them direct.